Play It Again Sports Moody s Rating

Moody'south Investor Services today announced upgrades to all of Deutsche Bank's ratings. Deutsche Depository financial institution's Counterparty Rating and Long-Term Deposit Rating accept been upgraded to A2, from A3, and the Non-Preferred Senior Unsecured Debt Rating moves from Baa3 to Baa2. Our short-term deposit and counterparty ratings are upgraded from P2 to P1. Additionally, all of Deutsche Banking concern ratings are placed on positive outlook again.

This is Deutsche Depository financial institution'southward outset operation-driven ratings upgrade from Moody'due south since 2007, and one of the few ratings upgrades of any major European bank past a leading bureau in 2021. Since November 2020, the outlook on Deutsche Depository financial institution's ratings has been raised by all leading agencies and Moody's placed Deutsche Banking concern on Review for Upgrade on May 17.

Moody'south said: "Deutsche Banking concern has made substantial strides to cut costs, solidify its revenue base and raise its underlying turn a profit potential. Stronger, more than diverse earnings, if sustained, will buffer the more volatile results of DB'south capital markets business in agin markets and – together with the depository financial institution'south meaningfully lower expense base of operations – equip the bank to achieve the fiscal targets ready out in its strategic overhaul just two summers ago. This prospect, along with DB's existing credit strengths of audio majuscule and liquidity, are reflected in our upgrade of the bank's ratings with a positive outlook."

Christian Sewing, Chief Executive Officer, commented: "Moody's determination to upgrade our ratings is highly appreciated and a bully recognition for the outstanding efforts of our people, who are transforming Deutsche Bank in a very challenging environment. Together, we accept built a robust concern model supported by potent capital and liquidity equally well as disciplined cost and adventure management. Our kickoff half 2021 results with profit improvements in all four business areas underscore the progress we have made on the path to sustainable profitability."

James von Moltke, Chief Finance Officer, added: "This is a milestone on our transformation journey. This motility by Moody's, a key stakeholder, validates the progress Deutsche Depository financial institution has fabricated since we launched our new strategy two years ago. Upgrades across both long- and brusk-term ratings help us fund our client activities on more than competitive terms. A positive outlook is a not bad encouragement for us to make further progress in transforming Deutsche Bank."

What's behind this move? Primal factors driving the upgrade

Successful execution of a unique transformation. Moody'southward commented: "Since announcing its strategic overhaul in summer 2019, DB has regained earnings strength; reduced capital and leverage exposure consumption; significantly lowered its operating costs; maintained strong liquidity; and reduced its dependence on […] marketplace funding. These achievements accept enabled DB to finance its strategic overhaul without significantly lowering its key capital ratios, leaving it on firmer ground than was achieved through previous, less central restructurings".

Refocusing on cadre strengths pays off. Moody's noted: "A primal element of DB's strategic transformation has been the refocus of its capital markets activities, and revenue mix, on less capital letter-intensive businesses disquisitional to growing its corporate customer base, which will be the core of its new business model. DB's ability to grow revenue during its restructuring has it alee of schedule to come across its 2022 revenue goals."

Well-positioned cadre businesses. The agency added: "DB'due south refocus on higher-margin businesses within stock-still-income and currencies has caused no visible customer or acquirement attrition… the acquirement mix is yet reasonably well diversified. Therefore, a slowdown in one or more than areas should not inordinately reduce the IB's restored revenue base of operations, allowing it to sustain skilful earnings fifty-fifty in a more normalised market. Moreover, rise global interest rates, in particular in the US, volition improve results in the Corporate Bank (CB) and Private Bank (Pb) segments from 2022 onward."

Potent progress on Sustainability. For Moody'due south, Deutsche Bank's sustainability strategy, is ahead of peers in cardinal aspects. Deutsche Bank, as Moody's notes, "has recently accelerated initiatives related to its Sustainable Finance Taxonomy to serve the growing needs of global corporates to arrange business models for sustainability goals. Early adoption of ESG policies and strategies will aid DB suit its solutions to clients' sustainability targets. The bank has already introduced band-fenced sustainable transactions in trade and supply chain finance. These include financing structures with ESG-linked incentives and penalties if sustainability targets, based on measurable key performance indicators, are not met. This revenue growth opportunity … is just one case of how DB is alee of the competition in developing and begetting the costs of ESG products and risk-direction capabilities."

Conservative balance sheet management reaps rewards. Moody'southward commented that "Deutsche Bank'southward sound capital and strong liquidity provide sturdy buffers confronting losses." The agency noted: "The bank expects to maintain a Mutual Equity Tier ane (CET1) capital ratio of around 13% for 2021 and beyond, providing a good capital base to absorb anticipated asset quality deterioration and resulting negative rating migration. DB's substantial pool of high-quality liquid assets remains a comparative credit strength of the group and has significantly reduced its refinancing chance."

Strong risk management. Moody's explained, "the bank'south loan book is well diversified, with moderate risk concentrations. DB'southward €445 billion loan book is well spread across regions, segments and nugget classes. About one-half of its lending is directed to High german retail and corporate customers, and we estimate exposures to riskier commercial real estate (CRE) and leveraged debt upper-case letter markets (LDCM) account for only a combined 9% of total gross loans. DB besides has depression exposure to unsecured consumer lending."

Sustained cost discipline drives returns to shareholders. Moody's commented: "In the second quarter of 2021, DB'due south adapted costs declined six% to €iv.6 billion, once once again reflecting workforce reductions and other price efficiency gains. But this restructuring has also delivered revenue gains, not attrition, so the cost cuts volition translate to materially improved operating leverage. This progress, if sustained, puts DB on rails to achieve its ambition of an eight% post-taxation render on equity by 2022."

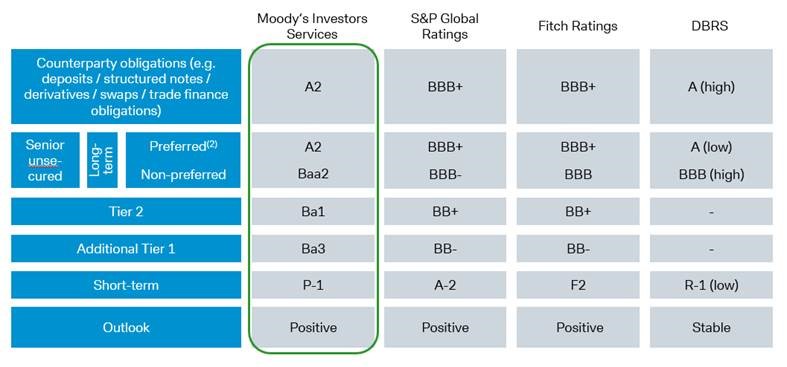

Afterward this move, Deutsche Banking concern'southward primary ratings with leading agencies are as follows:

mcneilhartatied1956.blogspot.com

Source: https://www.db.com/news/detail/20210804-moody-s-upgrades-deutsche-bank-s-ratings?language_id=1

0 Response to "Play It Again Sports Moody s Rating"

Post a Comment